What Expert Swapnil Bugde Sir has to say about Current GST Scenario (Part 1)

Interviewed By PracticeGuru dated: 7th March, 2021

3 Min Read

Introduction of Our Expert, Swapnil Budge Sir

Like in cricket we have thinking cricketers, Swapnil Sir is a thinking Professional. He has his own observations on current affairs, has his opinions and he articulates them so well. His views are always fair and balanced.

He is from Indore, his ancestral (or native place), but his grand-father shifted to Jalgaon in early 1950s and started a tax consultancy firm since then, which was later managed by his father and uncle. Swapnil Sir had no inclination or liking towards this Tax profession, nor did he has any formal education in it. He is a commerce graduate (considering his study of matters of finance and taxes he is no less than any Chartered Accounatant) and had learnt web development and programming, at a time when a career in computers was considered as niche. However he had to enter tax practice due to a sudden family issue and then he had to tread that path rather unwillingly. He started working in March 2006 and until about 2009 he was just working without any aim. In these 3 years all he could do was read the (VAT, CST, PT) Act and use his knowledge of computers to make compliance simple for himself and all his clients. This was a building block for him. It is since then, that his clients were familiar with due dates, the importance of timely compliance and were conversant with the provisions of law. It may not be out of place to admit frankly that he may be one such rare professional, whose clients take his follow up instead of him taking theirs.

PracticeGuru (PG): So Sir, You were in GST Practice from Day 1 ?

Swapnil Bugde Sir(SB):

Yes. From Day 1.

PG: Do you think, GST is doing what it meant to do for Business and Nation?

SB:

Well, it was not meant to do anything different other than collecting taxes easily. GST is an advanced version of VAT. For the taxpayers, the benefit of GST over VAT was that they could claim credit of taxes paid on purchases effected in the course of inter-state trade, and, another very important advantage was that their input credit could be verified (by satisfying all the conditions prescribed by the law) before filing of the return itself.

However, since the system of return filing has not been in accordance of law, the ease of compliance element for the taxpayers has lost, and they are subject more scrutiny from the departments than before. The other blunder was to have monthly return filing periodicity for all, irrespective of their liability. Therefore one may say that GST is giving revenues to the governments with complete discomfort to the taxpayers.

PG: Is there One Nation One Tax ?

SB:

Till electricity and petroleum products aren’t brought into the ambit of GST, there won’t be a true One Nation One Tax.

PG: Sir, Can we say there is seamless flow of ITC ?

ITC should never be seamless.

SB:

Seamless ITC is a catchphrase given to us by marketing brains. ITC should never be seamless. There are conditions to claim, take and get ITC. If those are satisfied, only then one gets ITC. The GST law goes a step further and provides an upper time limit for claiming unclaimed ITC. It is telling you indirectly that ITC is a concession. A real tax practitioner should never get carried away by such catchphrases and by the same token, should not be worried if there is no seamless ITC.

PG: How Infosys is doing ?

(for Readers knowledge:In 2015, Infosys was awarded a contract worth Rs1,320 crore to build and maintain the technology network for implementing the GST system across the country.)SB:

There are restraints on what Infosys can do with the Portal. One cannot perform an angioplasty on a patient unless he is admitted and sedated. One cannot work on a car’s engine when it is running. There are therefore limitations on what Infosys can do. At times, we feel sorry for the hard working engineers of the company. They are employed on one such project, where nobody directly concerned with it are happy. And the unhappy period is increasing without any solution in hindsight.

Only grouse one can have with Infosys is that they should abstain from claiming that the Portal was working “fine” when actually professionals from the whole country are saying that it was not. It adds salt to the injury and cause undue bitterness.

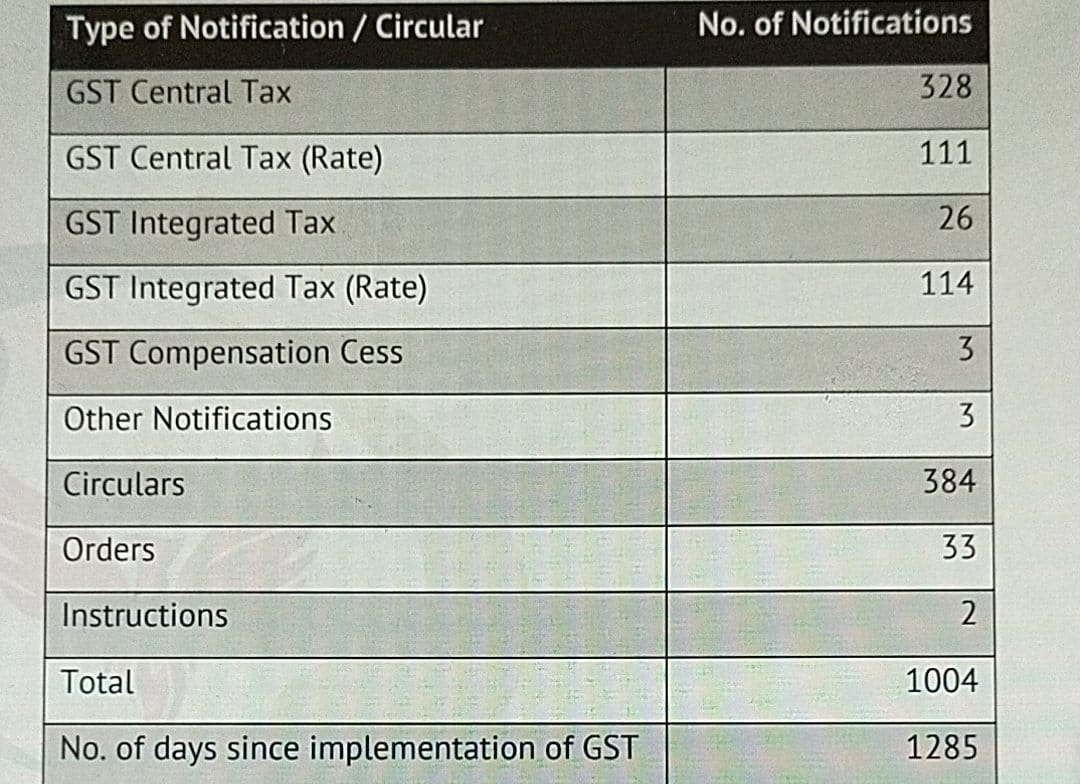

PG: Why so many notifications ?

(For readers knowledge: There are more than 1000 notifications in 3 years period.)

SB:

To cover up the wrong doings of earlier notifications. Our GST is stuck in two issues. One is that there was no address verification before granting new GSTIN, due to which the issue of fake registrations went out of control. Second one is whatever compliance is done so far, is exactly opposite to what the law has stated. Those who took bogus registrations due to a lackadaisical registration policy also used the flip flop compliance system and exploited it. The policymakers have now taken correct stance on new registrations. But then the recent conditions prescribed to avail ITC are hurting genuine RPs.

And it does not have any blueprint on how to tackle the ‘compliance opposite of law’ problem with the genuine taxpayers. GSTR 3B was not a return and even after making it a return, it does not have the features of a return. Every issue we see today is somehow, someway directly related to GSTR 3B. The form simply is hurting the very soul and intent of law. An all-out comprehensive Dispute Resolution Scheme is the only way out.

PG: What are Taxpayers going through ?

SB:

An uneasy phase.

PG: How MSMEs are feeling ? What are their requirements ?

(For readers Knowledge - read here to understand the background)SB:

A simple compliance which is in accordance with the law.

PG: Swapnil Sir, How Professionals are feeling ? Today we see, many have reached the stage where they want to leave Practice ? Recently there was new provision introduced which said CAs will be held responsible.

Professionals are tensed and under pressure all the time.

SB:

They are tensed and under pressure all the time. Not because of work pressure, but because they are experiencing the adverse effects of an unequal playing field. If a professional is wrong, he has to pay a price. At times monetary price and most of the times a price in the form of bad repute. However, policymakers have no accountability. They can issue number of notifications, they can cover their earlier wrong doings by retrospective amendments without thinking of the hardships caused to people and they can do this very easily with full government support.

PG: Amnesty is required ? Is it not unfair for people who have paid huge fees already ?

SB:

Yes. Give us the facility to file a payable return (which is by the way as per the law). I’m 100% sure that a payable return will end all miseries. And give a comprehensive DRS for the initial 3-4 years. There won’t be any issue.

Swapnil Sir gave honest and well rounded answers to this part of interview. You must have enjoyed reading the interview as much we enjoyed talking to Swapnil Sir. Also it must have helped you to get fair idea of issues being faced by Businesses as well as professionals and how can they be solved. We will release the part 2 soon. We sincerely thank Swapnil Sir for this.

Disclaimer:The information contained in this website is for general information purposes only. The information is provided by PracticeGuru and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

You may send in your articles on [email protected] . We will publish them on our website with credit to you.

Now ask question in any of the Categories of finance, tax and related areas and get Answers from Experts on practiceguru.pro

Ask QuestionsSubscribe for Updates

Want to Grow Practice and Put it on Auto Mode

Register NowRecent Articles

Everything you need to Grow CA Practice

4 Thing to Focus to Grow CA Practice

Top Networking Ideas for CAs