9 Implications of Audit Trail Notification of MCA

Written By PracticeGuru dated: 25th March, 2021

2 Min Read

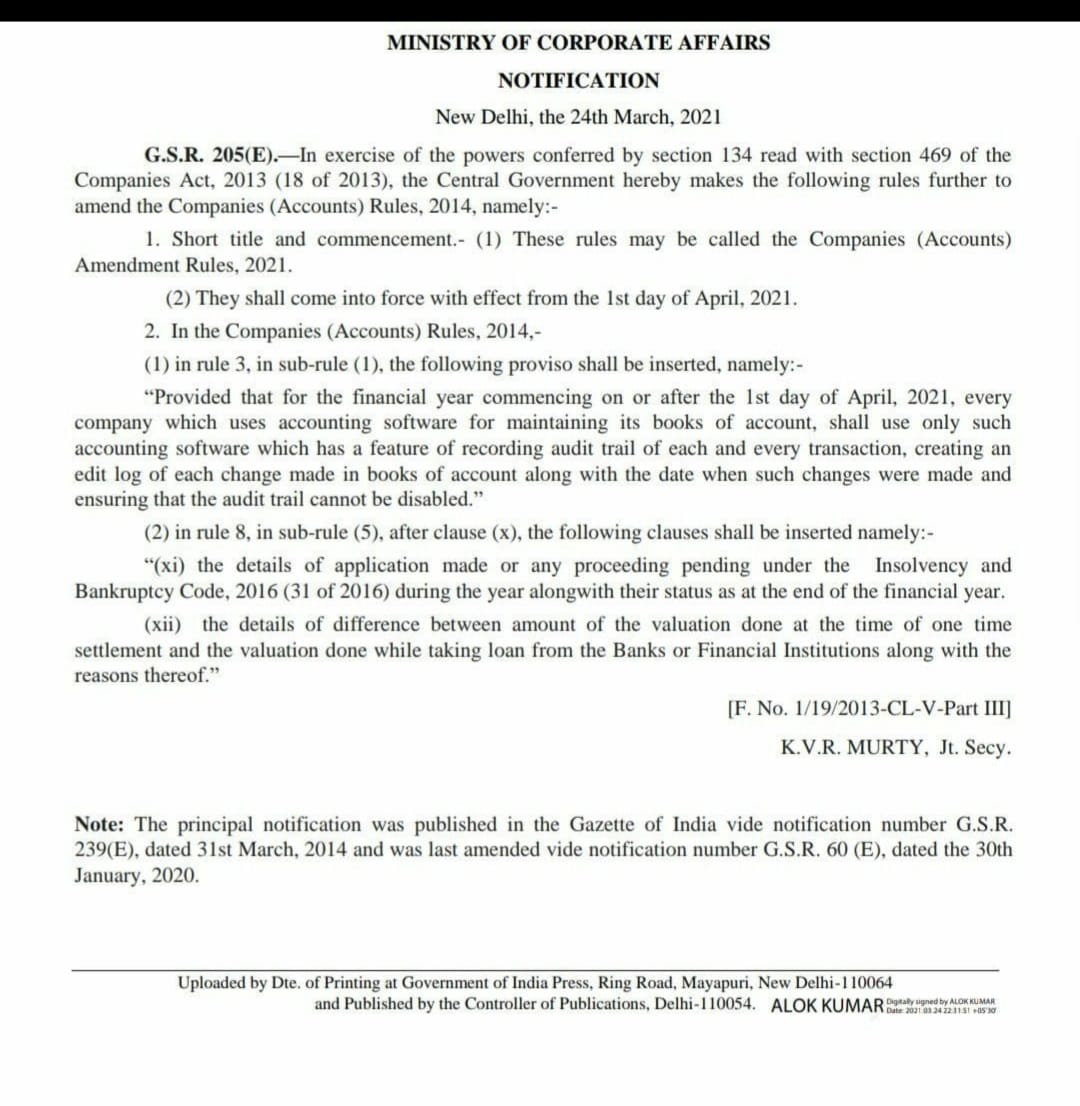

In exercise of powers conferred by Section 134 read with section 469 of the Companies Act, 2013, the central government made certain amendments in Companies (Accounts) Rules, 2014 regarding accounting Softwares used by Companies. Also now auditors are required on comment on the same in their audit report.

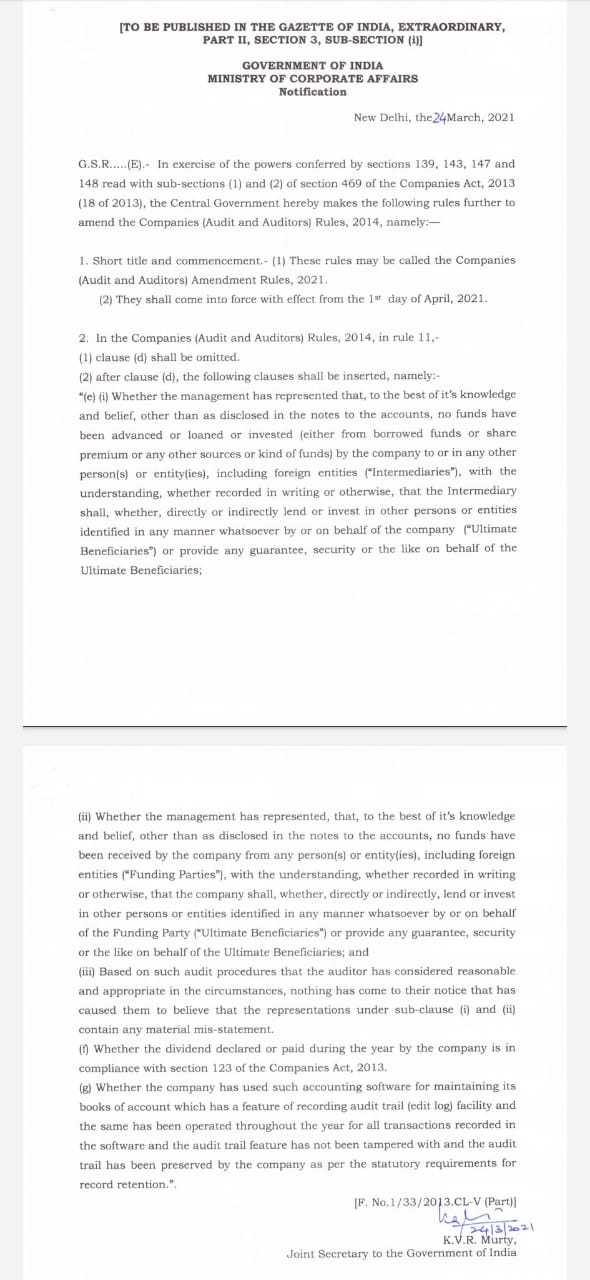

Also, In exercise of powers conferred by Section 139, 143, 147 and 148 read with sub-sections (1) and (2) of section 469 of the Companies Act, 2013, the central government made certain amendments in Companies (Audit and Auditors) Rules, 2014

Accounitng softwares are now required to have a Audit Trial feature which can track all the edits made to a transaction in the software. This will come into effect from 1 April, 2021.

Lets understand what can be implications of this for Business and for Auditors.

Very Less time for Implementation

This new change comes into effect from 1st April, 2021 and so its notified just 1 week in advance. Everyone involved will have to understand the requirement in detail, its implications on business, audit and costs. It is not possible to make such a big change in a weeks time for businesses and software vendors.

Is it possible for big manufacturing or trading Businesses to change Accounting software in a week ? Selection of software, selection of vendor, migration, audit of data migrated can be done so fast? Are all software companies ready ? Software companies are our partners in nation building, so is it fair to put them in such pressure?

Can ICAI come up with a Guidelines anytime soon?

Clients will start calling CAs for guidance on how to handle this and implications of this notification. Before guiding clients, CAs will need guidance from ICAI on many open issues. Can ICAI come up with Guidance note within a week ?

We feel ICAI will have to come out with a Guidelines on the Audit Trail point as there are many open Questions. Commenting on software will need Technical knowledge on part of Auditors ? How to audit it for whole year, on test check or random basis ?

This notification talks about Audit Trail of Transactions. What about changes made in Masters. What if someone makes changes in Head of Accounts ? Is that not required by MCA ? There may 100 fields in a transaction, whether audit trail is required to be maintained for each of these fields?

Extra Costs to business

It is possible that to have this extra feature, there may be requirement of additional data storage in the software and consequent increase in costs of software.

Using traditional accounting methods or Excel for Accounting may not be ruled out for small number of transactions ? How to take care of audit Trail requirements in such cases ? or such companies are not required to maintain audit trail? Do such differential treatment good ?

Many Businesses have Already paid for Accounting software for FY 21-22. Now if in this case, the software vendor is not ready to roll out change from 1 April, should Businesses take refund and move to another software vendor in a week ?

Manage Team, Clients and Works Easily and Smartly

Register Now

It is FREE

Implications for Audit Profession

This way there are 100s of features of Software (whether accouting or other), which can replace CAs as far as #audits are concerned. Dear #CAs, if this can come in effect, in future lot of provisions can come which will take away CAs work.

We feel timline is very strict and should have been made effective from FY 2022-23. We also request ICAI to come up with Guidelines very fast on this. What do you think about above implications, write in comments box and let us know.

Read the Notifications below

Disclaimer:The information contained in this website is for general information purposes only. The information is provided by PracticeGuru and while we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website.

You may send in your articles on [email protected] . We will publish them on our website with credit to you.

Comments

Now ask question in any of the Categories of finance, tax and related areas and get Answers from Experts on practiceguru.pro

Ask QuestionsSubscribe for Updates

Want to Grow Practice and Put it on Auto Mode

Register NowRecent Articles

4 Thing to Focus to Grow CA Practice

Top Networking Ideas for CAs