Income Tax Form 26AS

2 Min Read

What is Form 26AS?

Form 26AS is an annual statement which has details of the tax credited against the PAN of a tax payer.

It includes info on tax deducted on your income by deductors

Details of tax collected by collectors

Advance tax paid by the taxpayer

Self-assessment tax payments

Regular assessment tax deposited by the taxpayers (PAN holders)

Details of refund received by you during the financial year

Details of the High-value Transactions in respect of shares, mutual fund etc

Why do we need Form 26as?

We need Form 26as because it provides proof that tax has been deducted and collected on our behalf. Further, it confirms that employers and banks have deducted the accurate taxes on our behalf and also deposited into the account of the government.

How Form 26AS can be viewed?

There are 2 options -

1. Register and login

Steps-

Step 1: Go to https://incometaxindiaefiling.gov.in/

Step 2: Register and Login to the portal.

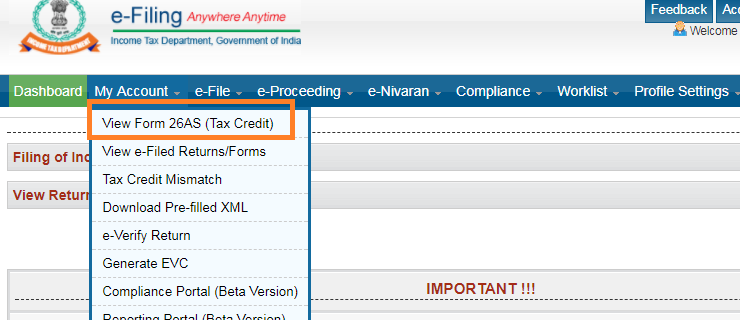

Step 3: Go to 'My Account' tab and click on view Form 26AS (Tax Credit)

Step 4: Select year and PDF format to download the file and proceed further.

Step 5: Open the downloaded file

2. Through New banking.

When Form 26AS is updated?

The Central pay commission processes TDS Returns. TDS Returns are filed on quaterly bsis. The last day of filing of TDS return for quarter 4 is 31st May. Further 7 days are taken to process the TDS return filed. Once the processing is completed, form 26AS will be updated with the latest amount of TDS deposited against your PAN.

Is there a password to open Form 26AS?

The password to open form 26AS is taxpayers date of birth in DDMMYYYY format.

What is the meaning of transaction date and date of booking mentioned in form 26AS?

Transaction date means date of credit or payment whichever is earlier. Date of booking means the date on which TDS return is processed and amount is booked in 26AS. This date will be a date after the TDS return is filed.

Go Back to All Blogs